Incurred and Ultimate Loss Ratio

A few months ago, during a discussion, some friends of mine asked why not just consider the experience reported to date and exclude any provisions for losses not yet reported. Ultimately, they were asking about the need for IBNR reserves and the difference between incurred and ultimate loss ratio when considering performance of any given portfolio.

Below therefore a brief and high-level outline of the main differences and components of each of these metrics.

Incurred Loss Ratio. The ratio of sum of claims paid and case reserves to premium is called incurred loss ratio.

This provides information about the claims that have occurred, been notified to insurer, and reserved (or even paid out), however it does not consider (1) the losses that have already occurred but are yet to be notified and (2) further developments of the already notified losses.

- Losses that have already occurred but are yet to be notified. Let us consider an example of professional indemnity insurance. Assume a solicitor gives out an advice, which later turns out to be inappropriate. Their client follows this advice and few months later suffers financial damages. The financial cost of that event took place few months after the initial advice, however the insured event occurred at the time of the meeting between the lawyer and their client.

- Development on already reported losses. The second element that incurred loss ratio does not account for, are developments on losses already reported to the insurer. Some matters simply need more time to be quantified and may be subject to legal proceedings, negotiations, or many other aspects. As such increases may be only accounted for months or even years after initial reporting.

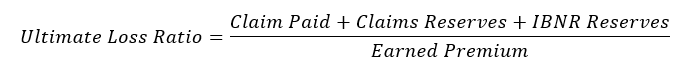

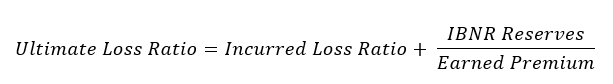

Ultimate Loss Ratio. A better measure of performance is therefore the ultimate loss ratio. This adds additional reserves for the elements not yet known to the insurer, namely IBNR. These are defined as Incurred But Not Reported and cover both of the loss developments above. Another words this covers for the liability from losses that have taken place, however which have not been notified to the insurance company. The formula to calculate these is as follow.

or

Both metrics have their application. It is just important to remember that in order to understand profitability of the book, amongst many other elements, one should always include IBNR in their estimations.

Thank you for tuning in. Keep in touch.

Until next time

M | K

Member discussion